Falling Oil Price slows US Fracking

Recent falls in oil prices alter the financial dynamics of oil extraction. Certain sources of oil entail lower costs than others. For example, conventional pumped oil extraction in high pressure onshore wells costs relatively little to set up and operate, whereas remote oil fields beneath icy seas require specialized equipment and override wages to locate and extract. When the oil price rises, more difficult oil fields become economically viable, when the price falls, the margins of extraction remove the viability of certain sources. Hydraulic fracturing in the United States has provided an unexpected source of oil. However, it has contributed to an oversupply that could soon cause fracking production to shut down; as a matter of fact applications for new U.S. well permits dropped by nearly half last month. US oil production is slowing down because of low oil prices and today we'll explain the reasons for that decline and explore the solutions.

Economics 101

When there is more of a product available for sale than there is demand, then buyers can shop around for lower prices. Different suppliers have different financing models and so those with loans to pay back soon will panic and drop their prices drastically to make sure they sell all of their stock quickly. Those who decide to tough it out soon find their unsold wares piling up. Sooner or later, they have to decide to stop increasing their inventory of unsold product, and shut down production.

The classic market involves many different producers in many parts of the world. Each has different priorities and strategies. However, economic theory applies to all markets and sooner or later the same pattern of actions emerges. The weakest go out of business, or mothball their operations, while the strongest sail through the crisis with only reduced profit margins to show any damage of the period of oversupply. In the oil business, the strongest players are the Gulf states and the strongest of all is Saudi Arabia.

Bubberlin' Crude

Just like Jed Clampett of the Beverley Hillbillies, the Saudis need to do little more than stick a pipe in the ground and pump to get their oil into barrels. Crude oil literally oozes out of the ground and once the Saudis break through the top layer of sediments, the sheer pressure caused by the vast quantities of compressed underground oil means they often don't even need to pump very hard. Under such conditions, start up costs for new wells are minimal. Moreover the Saudis have such cash reserves that they don't have to go to any banks for loans. Saudi Aramco, the state-run oil company can pick and choose which engineering partners they will send along to do all the work for them, and oil extractors compete fiercely for the privilege, forcing Saudi costs down further.

Complicated Structures

Oil forms in pressurized cavities that lie between strata of rocks. The classic Saudi oil field is like a vast underground lake, or river of oil. The conventional US oil fields of locations like Texas had the same characteristics. However, the extra production of oil enjoyed by the USA in recent years is sourced from more complicated geological structures. In that case, Fracking gets oil out of stone. Where oil forms near porous rock, it gets drawn into the rock, rather like water into a sponge. Fracking involves bombarding the rock with a mixture of oil and chemicals to break it down, thus releasing the oil inside.

More complicated oil sources lie in rock strata that have been buckled and ruptured by seismic activity. In these cases, the classic gap between rock layers gets interrupted and chopped into sections by the deformed strata. Enterprising American prospectors made these small pockets of oil economically viable by introducing horizontal drilling. Thus, their drill cuts through the blocking rock structures, enabling them to extract oil from a string of small cavities and reduce the overhead of drilling new wells for each pocket.

Costs

A major factor influencing the cost of extraction is the lifecycle of each type of oil source. Saudi wells last longer. There is more oil to pump within each cavity and so the cost of setting up that well can be written off over a longer period than the cost of setting up a fracking and horizontal drilling operation. A long-term producer can also write off the cost of distribution methods over a longer period. So if a new well can be built alongside existing roads and pipelines, that method will end up cheaper in the long run than fracking in remote and previously unexplored areas where a new pipeline or railroad infrastructure adds to setup costs.

Staff costs are higher with fracking methods because each drilling site is distant from earlier sites. Any oil extractor has to spend time and money locating staff for each project. Those employees then need to be transported and housed. If a well lasts for decades, the same accommodation can be used for staff over a longer period than the short-term nature of each fracking location. The peripatetic nature of fracking also means that staff will be less likely to settle in one place with their families and therefore demand higher wages to compensate for the loneliness of working away from home in freezing -40F North Dakota winters.

Capacity

Fracking is more expensive than extracting oil by conventional methods. Thus, conventional producers can afford to keep extracting and selling their oil at lower crude index prices than frackers. So why bother investing in hydraulic fracturing and horizontal drilling? A high oil price offers an incentive to endeavor. American oil exploration and extraction companies would much rather work in their own country, and in their own language, than have to travel to unstable places and risk hostile cultures in order to make a living. Thus, US oil companies expanded production in their own county once prices reached a certain level where unconventional methods became economically viable. Financiers and investors had little risk of losing their investment. The OPEC countries consistently trimmed their output to match world demand, so projections of oil prices and rates of return created a one-way bet.

American oil producers could just keep increasing capacity infinitely (or so it seemed), because someone else would adjust their output to make room in the market. Prospects looked good for expansion because cutbacks in OPEC production meant America could just keep taking a larger and larger share of the market.

Circumstances

The Saudis and their cheap-oil Persian Gulf neighbors suddenly had enough of making room for American expansion. They knew that they had been obliging to other nations, but felt that they had not been treated with the courtesies that they deserved. Saudi Arabia was particularly angry that America and its Western allies had failed to topple Bashar al-Assad in Syria and they were furious with Russia for blocking initial attempts to oust the Syrian president. The sudden return to market of Algeria, Libya and Iraq meant that OPEC began to overproduce. Under normal circumstances, both this extra production and added capacity from fracking would have prompted the Saudis and their OPEC allies to reduce production to maintain price levels. This year, the Saudis switched tactics and decided to defend their market share no matter where the price went.

Endgame

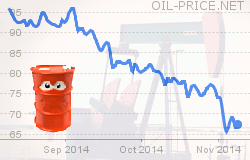

A falling oil price punishes Russia and brings economic realities to calculations over whether to invest in further oil exploration. Fortunately, this tactic is not the disaster it might at first seem. The second part of any price calculation lies with demand for a product. At the same time that oil supply surged, demand for oil dropped. China maintained the illusion of growth over the past year by over-ordering raw materials. Now they need to absorb their stocks, which takes a large part of world demand for oil out of the market. Europe's growth is stuttering, removing more demand. Economists calculate that for every 10% drop in the price of oil, the world's GDP will grow by 0.1%. Evidently, the current falls in oil price will eventually correct the lack of demand in the market and supply and demand will return to equilibrium.

Pricing

Faced with lack of demand and falling prices, any business has three options: carry on regardless; reduce, or suspend production; or lower costs. Saudi Arabia chose option one. This strategy relies on others either going out of business, or suspending operations to reduce supply. The Arabian producers can afford to pick that option because they have the lowest production costs among all oil producers. According to Morgan Stanley Commodity Research, some Middle-Eastern onshore production can break even at $10 per barrel. Others in that region need around $37 per barrel, with the average breakeven point for onshore wells in the Gulf states at around $27 per barrel. US shale oil doesn't start to pay back until it achieves a price of at least $50 per barrel. Current production costs vary between that breakeven point and a price of $80 per barrel.

Long Term Effects

The depletion rate of fracked wells is high. Bakken production for any given fracked well declines 45 per cent per year, vs. 5 per cent per year for conventional wells. So after one year the same well produces 55% of its initial output, after two years that reduces to 30%, and only 17% after 3 years. Producers need to keep drilling in order to stay in production with a steady flow of oil. This series of wells at different levels of depletion in production by the same company is termed the "drilling treadmill."

Although in established fracking states, such as Texas, it takes only seven days to get permits to start extraction, production in other regions, less used to the process can entail months of delays from legislators and pressure groups. Environmental restrictions placed on potential sites can pile on costs and make the benefits of extending the method into new locales a pricey prospect. Unfortunately fracking companies have already exploited the easier, larger reserves. Since on average each new well has a fixed start up cost of around $9 million, regardless of how much oil it will produce, further expansion of shale oil production will only break even north of the current $76-$77 level.

When oil sold for $100 per barrel producers gained a margin of $23 per barrel after a cost of $77 per barrel for drilling the existing wells and operating them. That margin provided funding for the "drilling treadmill" to create more wells. Therefore, although a falling price may not cause an immediate slow down in production, the disincentive of lower returns, longer delays and uncertain rewards could discourage future development. The loss of a profit on sales means fracking companies no longer have money to keep drilling new wells. This would cause a reduction in America's capacity to produce oil in the long term.

Solutions

High oil prices in previous decades did not spawn the shale oil revolution. That was created by advances in technology. Advances in technology originating from the same country that landed the first men on the moon over 40 years ago and made smart phones affordable to everyone today. The good old USA has the collective smarts to create a cheaper way to get oil out of the ground. American ingenuity always figures out a way.

It is time for the fracking industry to change priorities. The oil production landscape just switched gears from a gold-rush, money-grab mode to a survival mode. It has matured. It was easy to become complacent when oil prices were high and cash was flowing no matter what, but waste and inefficiency inevitably creep in. Some efficiencies can now be achieved by trimming the elevated royalties to land owners and extravagant executive bonuses. This may be painful for some but the Saudis are determined to keep the pressure up to squeeze out US competitors, so American shale oil producers have no choice.

Revisiting Foreign Policy to Saudi Arabia

US foreign policy towards Saudi Arabia is always a controversial subject. On the one hand the US public resents Saudi Arabia for contributing 15 of the 19 hijackers during the September 11 attacks. On the other hand, the US elite has made a habit of courting the Saudis behind closed doors, be it to peddle US weapons technology or to secure lucrative oil contracts. In 2010 Saudi Arabia purchased $90 billion worth of US war planes and weaponry, about half of the US Department of Defense budget for procurement. Although the Kingdom's oil reserves are nationalized, several US oil players play a privileged role in the exploration, refining and distribution of Arabian crude oil.

Historically the US oil industry and political sphere have been very closely intertwined. By antagonising domestic US oil producers, Saudi Arabia has turned against one of its most established political allies while at the same time trampling on American Energy Independence, a matter of National Security. Lots happen in Washington behind closed doors. The US has always met tough trading conditions with initiative and flair, so expect Washington to change course on its US Foreign Policy towards Saudi Arabia.

Published on 2014/12/08 by STEVE AUSTIN

Learn from our Research

We share professional crude oil price intelligence, research and insights.

Unsubscribe at any time. 60,000+ people are now receiving our research.