Oil Caused Recession, Not Wall Street

This essay brings a new perspective on the subject of the article oil-price.net titled "Did High Oil Prices cause the Financial Crash?" which we published in November 2009.

There is a lot of oil about. A lot left in the ground and a lot being produced. Amidst the contention, it is easy to overlook that Peak Oil is called Peak Oil because this is when we will never be more awash in the black stuff.

The abundant availability of oil buoys skepticism.

"What oil shortage?", doubters ask, with some justification.

Peak Oil is in part a symbolic marker. Like reaching the year 2000, the Queen passing her 50th jubilee or getting half way through a glass of beer. Notable, and in the case of the beer regrettable. However, Peak Oil will likely pass without undue trouble.

What matters are problems that will go along with the globe's production of oil maxing-out. The most important of these is likely to be the rising level of volatility in the price of oil.

In December 2009, The Oil Drum published an essay in which I asked the question - Was volatility in the price of oil a cause of the financial crisis? .

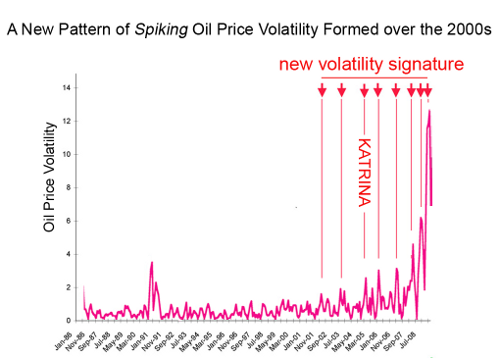

The crux of the essay is a chart (see below) showing that during the 2000s oil price volatility rose and fell over time in a distinct series of spikes.

This new volatility signature appeared to be unprecedented, but there was an added surprise in store. Further snooping led to the discovery that each spike in the oil series was matched by transient instabilities in other economic indexes, including inflation rate and investment risk.

The relationships shown in the essay were correlative. Care thus has to be taken since correlation in time does not prove causation. Bearing this in mind, the hypothesis posed was that these recurring spikes of volatility in oil price destabilized the investment environment. This destabilization was suggested to have led to a run on the shadow banking system.

As has been noted by Paul Krugman and others, the collapse of the shadow banking system was the falling domino that brought the financial markets crashing down.

Further indication of a link between oil and the financial crisis has come from the economist James Hamilton .

In a paper to the Brookings Institution, Hamilton computer modeled the effect of a rise in the value of oil similar to that of 2007-2008, when oil reached ~ $140. The model suggested that the GDP decrease occurring during the present recession could almost entirely be explained by the increase in oil price.

The take home from my work and that of Hamilton's is that the received wisdom may be wrong. Wall Street, sub-prime and regulatory failure are not the ultimate cause of the economic melt down . The root of this crisis is probably oil.

Now, readers may be saying to themselves:

Hang on. This is backwards. The 2008 oil shock occurred after the financial crisis started.

However, what the chart shows is that the shock of 2008 is not an isolated event. This recent run-up in oil price simply explains the largest of a series of at least 7 spikes in volatility, with the first topping out in 2002.

The identification of this distinct signal of instability in oil price, that initiated years before the start of the financial crisis, is a finding that sets my analysis apart from that of Hamilton's.

The idea that oil shocks resulting from Peak Oil may cause large economic disruptions is not new. A few brave thinkers, including Jeff Rubin and Matthew Simmons, have warned of this possibility.

What is new is that there is now real world data suggesting that this anticipated turbulent phase is underway.

A number of experts take an alternate view that speculation and the financialization of energy markets explain the recent upsurge in oil price volatility.

In a response to the Oil Drum essay, Chris Cook, the former Director of the International Petroleum Exchange, wrote:

"...the principal cause of the financial crisis and of the volatility are one and the same - to wit, the 'leverage' or 'gearing' derived in the former case by deficit-based credit creation by banks, and in the latter case by both bank credit creation and forward/futures contracts".

Chris's comment is based on his 25 yrs in the oil markets. Strong evidence opposing his notion is not available. Nonetheless, the chart provides food for thought for those who suspect that speculation is primarily responsible.

Many in the US will recall the sharp rise in gas prices coinciding with Hurricane Katrina. This price run-up in 2005 accounts for the spike in volatility marked KATRINA on the chart.

However, from the big-picture view given by the chart, it can be seen that there are noteworthy spikes in the years preceding and following that of Hurricane Katrina. As with the year of 2005, when Katrina struck New Orleans, 2004 had an active hurricane season. However, 2006 was comparatively quiet.

The point is that while Hurricanes, speculators or even Nigerian terrorists may act as triggers, such standalone factors simply cannot explain the multi-year pattern seen on the chart. This long-term twitchiness is likely to have a systemic basis, such as that which would result from a tightening balance between supply and demand as oil production peaks.

In comments on the essay, David Ramsey raised a second important criticism. Paraphrasing his line of skepticism, David asked,

What makes you so sure that this time it is different?

Adding the interesting suggestion, "A good test might be to see if there is similar data for some other commodity or product associated with prior bubbles that burst."

To test David's idea, I have begun comparing price changes in commodities prior to the 1929 and 2008 stock market crashes . Preliminary data suggest that the pre-1929 and 2008 patterns are not similar, supporting the idea that this time it may be different. However, caution is required as this part of the story is too preliminary to make a call.

The above being said, the fluctuating signature on the chart may be a pointer that the world is either approaching or on the down slope from Peak Oil.

Chaotic change in the value or availability of a non-renewable resource often occurs during its terminal decline. A good example of this was whalebone , a material used for hooped dresses and corsets during the 19th century. The price of whalebone underwent large fluctuations as the whale species from which it came were hunted to near extinction.

In an example closer to our own time, Atlantic cod numbers landed off New England have shown whipsaw surges and falls in response to over fishing. The author Jeff Vail has used chaos theory to show interesting parallels between volatility in oil price and how prey populations in the wild vary in relation to predation.

Because of my day-job as a biologist who studies the heart, I visualize volatility spikes as resembling the pulses of bioelectricity that drive the heartbeat. These electrical pulses (we call them action potentials) fire after reaching a critical level. The pulses then electrically conduct through the muscle of the heart, causing it to contract.

It is imagined that volatility spikes in oil price also have to reach a critical threshold before they are of sufficient size to transmit knock-on effects on economic variables like inflation rate and investment risk.

To continue the cardiological analogy, like a rare mistimed heart beat that can fire out of sequence and cause a heart attack, it was suggested in the essay mentioned earlier that the mysterious Black Monday stock market crash of 1987 could have been caused by a surge in oil price in the previous year set off by the collapse of the OPEC cartel.

On the time scale of the 24-hour news cycle, volatility spikes form slowly and for the most part, have been hidden from public view.

The volatility signature that formed over the 2000s has been too ponderous and below the radar for most to register. But to the overleveraged global economy, this near decade-long pattern of pulsed instability may have acted like repeating blows of a wrecking ball - each spike slamming with greater force into financial markets.

Wall Street behaved badly. However, this epic misbehavior was probably not the prime cause of the recession. Our dependence on oil is likely to be the real villain.

Published on 2010/01/20 by TOM THERRAMUS

Learn from our Research

We share professional crude oil price intelligence, research and insights.

Unsubscribe at any time. 60,000+ people are now receiving our research.