Low Oil Price Challenge met with American Ingenuity

The price of oil has been falling since July of last year, and many industry analysts have struggled to find a direction in the market. Many wish the price of oil would rise again and seek any signs of their hoped-for increase; others can see no reason for a rise and explain that the low price of oil is now the new normal.

A lower price for any commodity or service knocks out the least efficient producers. In oil, efficiency is not just a matter of hard work and economies of scale - some sources of oil are cheaper than others and available infrastructure plays a key role in making certain oil fields economically viable. Consequently US fracked wells were deemed to be among the most vulnerable producers to be squeezed out of the market. Fracking operates in remote areas of the US, which makes start-up more expensive and delivery costly.

While many doomers were forecasting that the US oil revolution had been killed off by lower prices, analysts in the know such as ourselves believed firmly it would survive. As oil-price.net predicted, the country that invented the Internet and the iPhone was not going to sit idle. American ingenuity went to work and found new ways to extract oil profitably at lower prices. The enterprising spirit of US frackers explains why they were not closed down by lower prices and actually managed to extract more oil profitably at these levels. Furthermore, the new drift between former partners seems to have directed each towards strategic policy changes.

The US and Saudi Arabia

Many see recent events in oil production as a straight battle between Saudi Arabia and the USA. American oil companies are the principal partners of the Saudi government and help extract and sell Saudi oil. The US need for Saudi oil and the Saudi need for US technology and military might have forged a close political relationship between the two governments, even though the religious and ethical views of the two countries are incompatible.

The Saudi royal family has had the US military at its disposal for decades in their struggles against regional rivals. The US administration is obsessed with securing enough oil to keep the economy running and, as the world's largest oil producer, Saudi Arabia was a constant focus of US foreign policy. However, during the course of 2014, that synergy broke down, and the new drift between former partners seems to have directed each towards strategic policy changes.

Saudi Arabia and OPEC

Saudi Arabia is the largest producer in OPEC, which is a cartel of a group of petroleum producing countries. The aim of OPEC is to regulate the price of crude oil by restricting, or increasing supply. Thus, if oil prices fall, OPEC reduces the quotas assigned to each of its members. This reduces over-production and brings supply and demand back into equilibrium.

Saudi Arabia has an OPEC quota to produce 12.5 million bbl/day (barrels per day), which is more than the next four largest producers in the club combined. Therefore, a reduction in OPEC output can only be achieved if Saudi Arabia agrees to it. No OPEC-led reduction in production will have any effect unless Saudi Arabia reduces its output.

However OPEC no longer controls all the oil in the world. Two growing producers of oil, Russia and the USA, are not members of the cartel and will not dance to OPEC's tune. Increased American and Russian output caused a glut in the oil market when predicted demand failed to materialize. An OPEC cut to restore equilibrium would have required even deeper cuts in Saudi output to compensate for non-OPEC production. In 2014, Saudi Arabia decided to implement its own production strategy and refused to cut production.

What Were the Saudis Thinking?

The OPEC quota system was traditionally seen as a way for oil producers to dominate the world economy. High oil prices limit economic growth in the world, but they ensure a slice of the pie for oil-producing nations. However, Saudi Arabia realized that their obliging production cuts just made more sources of oil viable, and so they were expected to reduce their income in order to make other countries richer.

The American drive for energy independence reduced the willingness of the US administration to invade countries at the behest of the Saudi royal family. In early 2014, the US's refusal to topple President Assad in Syria at the Saudi's request brought matters to a head. Russia's support for Assad increased Saudi anger.

Letting the price of oil fall would kill two birds with one stone. The Saudis realized that restoring temporary equilibrium to the oil market only made excess production in the long term more likely. This would allow new producers to erode their dominance of the oil market, losing the Kingdom market share and reducing Saudi influence over the American administration. They decided to maintain production levels and let the oil price fall to the point where economics cut production in rival sources. The fact that the more expensive production that would be lost would be in the US and Russia, was a bonus. Despite the loss of income, the Saudis decided that the restoration of their influence in America and the eradication of competition were worth the price.

The Saudis agreed that production needed to be reduced, but they decided that this time the reductions would occur in other countries, not theirs.

What Are the Americans Thinking?

The US surpassed Russia and Saudi Arabia as the world's largest oil producer in June 2014, one month before the oil price peaked and started to fall. Production levels are not as stable in the US where oil policy is lead more by market forces, as they are in countries where production levels are decided by autocratic governments.

Some journalists have insinuated that the US administration deliberately manipulated the price of oil down in order to punish, and defeat Russia, following their invasion of the Ukraine. Although President Obama is less interested in the oil industry than previous leaders, it is unlikely that he would deliberately scupper the US oil frackers as "friendly fire" in a covert war on Russia. Energy independence has long been a goal of all parties in the US government and anyone would have seen straight away that a fall in the price of oil would seriously damage that aim. The government's overt action of trade sanctions against Russia are more targeted and have fewer consequences for the US economy.

While foreign governments declare quotas, subsidies and penalties to try to grow their economies, the American way has always been to let the market decide. Laissez-faire economics require governments to have highly accurate forecasts at their disposal. The predicted rise in world growth did not materialize in 2014. That shortfall caught everyone out, including the big banks and oil industry analysts. The US government did not produce the oil price fall, it was just as surprised by it as industry analysts.

The Failure of Forecasting

The failure of oil industry economists to predict the price of oil was simply because most future predictions are based on examining what happened in the past. Everyone expected the Saudis to cut production and maintain prices as they did in the past. When they didn't, the fallout resulted in massive layoffs in the oil industry. The livelihoods of entire communities were decimated -- over 100,000 jobs lost worldwide by our estimates.

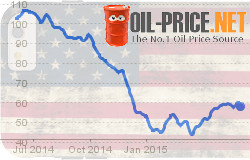

The oil price fell from $115 per barrel in June 2014 to around $55 per barrel at the beginning of 2015. Some analysts predicted that the price would continue to fall, while others saw a rebound on the horizon and others felt prices would stay the same for years to come. One thing analysts unanimously agreed upon was that US fracking was immensely set back, if not finished.

The average fracking well had a breakeven point at an oil price of $70 per barrel, meaning when the oil price dips below $70 the average fracked well is no longer profitable. This is why the number of drilling rigs in North Dakota plunged from 197 to 80 in less than a year. This simple fact told market insiders that the Saudi policy was working. American frackers were being squeezed out of the oil market, and having had their fingers burned on a failing industry, financiers were unlikely to back shale oil ever again. The American oil revolution was a busted flush and the US would have to go back to dependence on Saudi oil. Wrong again.

American Ingenuity Kicks In

The high priced oil phase of the shale revolution can be seen as the gold rush days of the industry's history. Frackers paid millions for mineral rights and a whole new generation of Beverly Hillbillies came into being. The shale oil extractors would build new schools, roads and community facilities to win support among the citizens of the one-horse towns they rolled in to. The shortage of labor in remote locations meant big money for anyone who was prepared to move out to the middle of nowhere to work on the rigs.

Frackers were seen as the bling of the oil industry. Established executives of traditional extractors believed that shale oil was a passing fad and would soon collapse when the easy money thrown at this fashionable investment opportunity dried up. However, the flashy image of shale oil extractors was merely a caricature that less agile producers liked to imagine. This low opinion of the industry spread to market analysts.

Oil industry insiders who predicted the death of shale oil in the United States got it wrong. They overlooked the fact that fracking is an innovative technology and the entrepreneurs that mastered it are quick thinkers and eager capitalists. The fall in rig count does not signify a dying industry. In fact, the start-up costs of a fracking well are the major contributors to that $70 per barrel breakeven point. By extending the life of wells, shale oil producers have slashed their costs.

US oil production has not reduced in the face of falling oil prices. American oil ouput has actually increased by half a million bbl per day since October 2014. Shale oil producers are getting more oil out of fewer wells and that factor is keeping the industry alive.

What happened? First off, the shale producers' tendency to spray money around ended. Accountants were called in to cut costs and trim unnecessary expenditure. The sector is maturing from one dominated by risk takers to one run by innovators. Rather than repeating the same old formula at every new site, oil producers examined new methods and rapidly evolved the technology in order to survive. Analysts now estimate that the breakeven point of new shale oil wells is $27.50 per barrel, not counting financing costs.

Improvements Made in Oil Production

Although the oil industry sees environmentalists as the enemy, shale oil producers actually listened to their concerns and took them on board. It happens that the main environmental concern over fracking is the massive use of water and it also happens that sourcing, transporting, storing and disposing of water are major operating costs of shale oil extraction. Instead the use of small plastic balls in the injection fluid to force open fissures now drastically reduces the amount of water needed in the extraction process and similarly reduces costs and the dangers of collapses post-extraction. Other water-reducing methods include a propane-based gel for fracking. Freezing fissures, or using recycled, or waste water for fracking are also environmentally-friendly fracking developments that help slash costs.

Greater care in treating, or eliminating waste water and preventing quakes and subsidence helps the industry's public relations profile. Funding legal processes to get permission to drill is a major start up cost and can cause potentially profitable sites to be sidelines for years while politicians and lobbyists argue over the permits. Environmental impact studies and the need to pay scientists and opinion-formers to build a case for a permit are also costly exercises and so the ability to extract more oil from each existing well through horizontal drilling reduces these overheads. Fewer wells also mean fewer communities are disrupted and the infrastructure needed to bring each location online can be written off over greater output volume.

Although few predicted that US shale oil production would survive the price crash, realization is starting to set in that fracking is not going to be forced out of the market. A recent strategy report by OPEC estimates non-conventional oil production would continue to grow by 6 per cent per year up to 2035.

A tighter control on spending and the application of cheaper technologies has slashed costs for exploration, resulting in an escalation of discovery of new shale oil sources in North America over the last six months. So, rather than receding, US shale oil is becoming more plentiful and cheaper to extract.

Conclusion

As can be seen from recent experience, predicting demand for oil is a difficult task. Technological advances make predicting supply levels even harder to achieve. America has always relied on enterprise and market forces to direct economic development and this strategy requires a degree of fatalism, and even faith.

Recent oil price falls did not lead to the extinction of fracking, it promoted efficiency in the sector, which heralds further price falls. Excess production will eventually squeeze out high-cost oil extraction - but it won't be US shale oil companies that go out of business.

Published on 2015/06/15 by STEVE AUSTIN

Learn from our Research

We share professional crude oil price intelligence, research and insights.

Unsubscribe at any time. 60,000+ people are now receiving our research.