Oil price at $35 amid bribery scandals

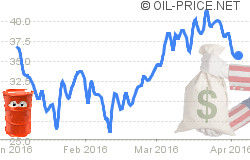

The Brent Crude Index hit $27.1 on January 20th this year - its lowest point since June 2003. The index's lowest point in the last 20 years was at $10.19 back in December 1998. As the price slid at the beginning of January this year, many analysts dusted down the history books and predicted that crude price were going back down to that level. After its January low, the price started to rise again, breaking up through $40 per barrel in early March. News headlines now filled up with predictions of crude getting back up above $100 per barrel by the end of the year. The International Energy Agency chimed in with a declaration that the low price days were over. What happened to change all the forecasts so drastically? How do industry analysts justify such extreme movements in predictions? How can the small investor make the right decision when a good tip gets reversed in a matter of a few weeks? Is the IEA right this time?

The truth is that industry analysts and journalists are the wrong people to follow for stock and commodity tips. Journalists are given instruction by their editors to produce a story on a particular theme and their taks is to write to the brief, even if the facts don't exactly fit with the editor's headline. Through selective blindness, statistical adjustments and incomplete data comparisons, a journalist, or a forecaster can make the figures point at whatever prediction their bosses, or their bank balances, urge them to do. Here we explain why you have to read behind market analysis, examining whether the writer has an agenda, and around the forecasts, looking for influencing factors that the analyst chose to overlook.

The end of cheap oil

As the volatile Brent Oil Price Index topped $40 in early March, the International Energy Agency decided to keep the ball rolling by producing its own predictions - the only way is up. The IEA predicted a fall in non-OPEC production of 750,000 barrels a day by the end of 2016. This was principally expected to be shaved off US oil production. The agency also noted that production in Iraq, Nigeria and the United Arab Emirates had experienced outages. Furthermore, the promise of a great surge in supply has failed to materialize. All of which means that the supply of crude oil to the market will be greatly reduced for the remainder of 2016 than it was in 2015.

On the supply side, world demand for oil is expected to rise by 1.2 million barrels per day. The IEA concluded that the oversupply in the market would soon end and that would consolidate current prices and encourage them to rise further.

The news media seized on this report and broadcast it around the world, adding on comments from industry analysts that the price would soon be back above $60 per barrel and, who knows, over $100 by the end of the year. "It is clear that the current level of demand is the correct one," the IEA declared, "although with a long way to go," they added, implying that the rally would continue. If you read the newspapers, or saw the TV news headlines on March 11, you would have concluded that oil had become a one-way bet. Getting in at $41 would have seemed like money in the bank. However, by the 15th, with the price down at $38.32, you would have felt swindled by the IEA's analysts.

The similar-sounding EIA, the Energy Information Agency, which is a division of the US Government's Department of Energy, chimed in on the evening of the 15th. They announced that deliveries to US storage facilities filled up at a slower rate than previous weeks. The Qatari Oil Minister announced a meeting to be held on April 17 among 15 OPEC and non-OPEC oil producers to cap oil output. These two pieces of news pushed the oil price back up above $40 by close on that day.

Selective blindness

Finance industry journalists can choose to ignore any factors that don't tie in with their vision of the energy industry. A recent example that highlights the fact that the financial media can be blindfolded comes with the recent Unaoil bribery scandal? Heard of it? Relatively few outlets dared cover it, certainly not major ones. In short, a self-professed "lobbying agency" named Unaoil, operated from Monaco by three Iranians paid massive bribes to officials of Kazakhstan, Iraq, Nigeria and other oil-rich countries in return for awarding juicy oil contracts to the clients for which they "lobbied". Unaoil's email server got compromised and 10 years worth of emails exposed for everyone to read; it turns out some of these clients are western oil companies, major ones.

Granted if oil prices were above $100, public outcry would be much higher and the story may have made more headlines. Right now, oil prices are in the $30s, too low to fuel resentment. Regardless of public perception and journalistic priorities, the federal government has a role to play in the story, and a big one at that. The Foreign Corrupt Practices Act (FCPA), especially crafted to address this sort of situation, draws very clear lines on the subject of bribery. Oil companies involved in the bribery scandal are liable to be fined in the billions of dollars, so expect lower dividends from these companies and their stock valuations - already pressured by low oil prices - to take a hit. Hopefully you did not buy low - yet.

It is easy to draw parallels between this scandal and the 2008 banking crisis but in reality these are two events extremely dissimilar. The 2008 banking crisis happened because of the lack of legal safeguards at the time and as a result very few bankers were sentenced as they did not break laws. By contrast the present scandal involves willingly breaking existing federal anti-corruption laws. There will be consequences because laws were infringed upon. But this Monaco-based lobbying agency acting as a middle-man may be the get-out-of-jail card for some executives who may plead not knowing what was happening. And one can could reasonably argue that exchanging donations for influence - from a corporation via a lobbyist to a politician - is generally how lobbying functions domestically, even domestically. Anything can happen in an election year.

Read between the lines

A few pieces of news over the space of a few days drove the oil market to lower prices by 5 per cent and then raise them by 5 per cent. The first day of good cheer seemed to have the reverse effect on prices to that desired, seeing them drop. The second day of good news reversed the fall of process on the 11th.

None of these market-moving announcements actually had any substance. The IEA cited weaker than expected production increases by Iran as one of the reasons that the supply of oil will not rise this year. However, this is not true at all. Despite the embargo against its oil, Iran still maintained a quota of 4 million barrels a day from OPEC. It hasn't met that target for some time. However, its output low point was 2.5 million barrel per day back in April 2013. By the end of the embargo the country's production was at around 2.7 million barrels per day. Since the beginning of this year they have raised their output to 3 million.

No one expected Iran to get up to full speed straight away. They need to raise capital, sign deals, and build new wells to get up to full capacity. However, they have stated that they will get up to their full quota of 4 million barrels per day by the end of the year and nothing the Saudis or OPEC can do will stop them. They will not countenance a lowering of their quota. All the OPEC members accept this stance, and reinforce it, because none of them, including the Saudis, intend to reduce their output.

The forthcoming meeting in Qatar will not be attended by Iran, and those who will be there, including Russia and the Saudis have already agreed the outcome of the conference. Participants will pledge to hold their production at January levels, when they were extracting oil at maximum capacity. Countries that are below their allowed production quotas - Iran, Iraq, Nigeria, and the United Arabic Emirates will be allowed to increase production to their OPEC quota levels. Those countries have not had outages that will stop them producing, they are all overhauling their production facilities so they can actually increase output. They will return with greater capacity before the end of the year. So no actual reduction in current output levels forms part of the April 17 agreement - quite the reverse, it allows all parties to maintain their maximum levels and, in some cases increase production.

Non-OPEC production

Another element of the IEA assessment of supply in the crude oil market was an expected 750,000 barrel reduction in output per day by the non-OPEC countries. The United States and Russia are by far the two largest non-OPEC producers.

As Russia needs to keep pumping at its maximum capacity to balance its state budget, the IEA's prediction can only hold true if the USA drastically cuts its production. The EIA report that deliveries to storage had not reached expected levels on the previous week seemed to confirm this prediction and it caused the market to rise on the 16th. However, brokers and investors do not seem to have read the EIA's statement correctly. It did not say that, although journalists cleverly implied that it did. In fact, the EIA reported that deliveries had pushed crude oil stocks to a record high for the 5th consecutive week. That shows that US oil producers are outstripping demand to a greater extent than ever before.

Elsewhere in the world, small losses may amount to a projected reduction of about 500,000 barrels a day. However, the governments of those countries are tackling the issue, which means that this expected output drop could be reversed quickly. For example, the UK's North Sea oil output was projected to fall by 100,000 barrels per day over the course of 2016. However, the British government announced tax breaks to oil companies, which will reopen mothballed rigs, thanks to the altered profit calculations, so even that small reduction in supply may actually turn out to be an increase.

Slump in demand

Financial analysts are weak at predicting future demand for crude oil. It is this side of the calculation on shortages and gluts that usually causes the industry to miscalculate supply requirements. Analysts rely on GDP growth estimates calculated by economics institutes, such as the IMF. However, they fail to predict shifts in behavior.

The Japanese government caught out energy analysts in 2014 when it suddenly decided to reopen all of its nuclear power stations. The Fukushima disaster had caused the japanese government to close all its nuclear power plants and reopen its oil, gas and coal powered generators for the foreseeable future. Japan's power companies came to dominate demand for oil and gas, and when that market disappeared, almost overnight and without warning in 2014, a glut in the oil market was created. No one saw that event coming, and by the time it happened, it instantly became yesterday's unwritten news. Journalists, looking for the next big story, completely ignored a major influence on demand for oil. They were already looking at the next event, and possibly overlooking it by order of their editors.

Lower potential

Analysts also fail to take on board the greatly reduced potential demand for oil throughout the world. China is replacing its coal-fired power plants with clean energy rather than moving into production driven by oil and gas. The United Kingdom is encouraging the construction of new gas and nuclear fueled power plants to replace its retired coal-fired plants. It's subsidies to householders to produce energy through solar power has resulted in every street in the kingdom lined with solar-panel-covered rooftops, which has enabled the government to reduce the number of electricity generating stations in the country. Germany and the Scandinavian countries are phasing out subsidies to the manufacturers of electric cars, because the sales volume of these vehicles has achieved critical mass and can compete with fossil-fuel engines in the open market. Green energy's success means that part of the supply market has been lost to oil.

However, developments in energy-saving technology are all topics of interest to environmental journalists. Financial industry writers rarely cover such topics. Any impact that alternative energy sources may have on the oil market is simply not on the average financial industry journalist's radar.

Limited expertise

The world economy is unlikely to grow this year, and is at serious risk of collapsing. The US Federal Reserve's inevitable interest rate hike will kill of growth in America. Chinese growth is all in the financial sector, which does not consume oil. Fuel and power-needy factories are retrenching - for example, just one of China's state-owned steel producers announced 50,000 layoffs this month. Japan has now entered recession, despite a massive bout of QE from its central bank at the beginning of this year. Earlier this month, the European Central Bank threw the kitchen sink at combating deflation in the Eurozone, which no effect at all. These examples of the ineffectiveness of central bank actions has made it clear that all of the liquidity tricks that have kept the world economy afloat since 2008 have run out of steam.

All of these facts are widely reported on the finance pages of the world's newspapers, but financial industry commodity journalists are not obliged to absorb this research. Since the beginning of the year, small investors were informed on the financial pages that the Bank for International Settlements has led a rush of warnings over the past month on the instability of the world's banking system. Recent crashes on European and Chinese stock markets reflect investor nervousness about the inability of their banks to cope with any external shocks. Researchers at the Wall Street Journal reported that US listed companies were already in an earnings recession in 2015, where high turnover results in little to no profit. This is a measure that proved to be a warning sign of the 2008 financial meltdown, and it is happening again. JP Morgan Chase market analysts see an 81 per cent chance of a global financial meltdown this year. Citibank calculates a 65 per cent chance that the US economy will enter recession in 2016. Over in London, RBS analysts urged their customers to sell all their stocks back in January of this year once their research pointed to an imminent collapse in the world economy. This was closely followed by Société Générale's warning that a recession was within sight.

Analysis of economic factors are all topics for the business pages. The IEA's weak analysis of demand, missing all of the danger signals that point to a sudden decrease in economic activity and a reduction in demand for oil are not the concern of financial industry journalists and their editors, and so no scrutiny was brought to bear on the IEA's overly-optimistic estimates on demand for oil.

Market behavior

The market seems to have behaved irrationally, falling despite all the good news the IEA put out there. In fact, as soon as the little investor started buying, the big boys started selling. Why? Because no one can sell unless there is someone out there who wants to buy. Who wants to sell? The banks and the oil companies that employ the industry analysts. Unfortunately, the number of units that the big boys took the opportunity to offload exceeded the increased buying activity that the IEA's happy statement attracted to the market, so the price of crude oil fell back.

The dip back below $40 removed a lot of automatic sell notices that a landmark price level such as $40 triggers, hence, with selling orders removed, the price rose back up above $40 two days later. That rebound probably had nothing to do with the EIA report, or the Qatari meeting announcement. It was what is sometimes called a "dead cat bounce," and the oil market is likely to see a lot of these over the coming year. Crude oil prices will probably trade between $20 and $40, bumping along the bottom for the rest of this year. As has already happened so far this year, a concerted effort by cheerleaders to get the casual investor into the market initially causes the price to rise up to the $40 mark, when offloading begins and the price falls back down again.

Investor information

Cheerleaders that skew the data to their wishes actually create the problems financial journalists hope will just evaporate. Financial industry analysts advise oil companies on when to invest, and banks on when to lend to producers. The fact that they got these calculations wrong in the early years of this decade is what caused the current oversupply.

Happy-times journalists who look the other way while the industry they cover commits fraud and bribery cheat their readership of the accurate information they need as input to their investment decisions. The small investor has to look beyond the mainstream media to get the full picture before committing savings into stocks or derivatives.

Here at oil-price.net we stick unswervingly to analysis of the underlying cause of the movements in the price of crude oil - supply and demand. By keeping a constant eye on the supply/demand situation and making realistic assessments of both, we keep our readership armed with accurate forecasts of the market's direction. We avoid getting sucked into the euphoric hoopla that market makers generate from time to time when they are just desperate to offload their trash onto the small investor. The result of our steadfast adherence to the facts shows through in our record. Take a look through the oil-price.net library of articles and you will see that we have never been swayed by fads, and all of our predictions came true.

Published on 2016/04/06 by TOBIAS VANDERBRUCK

Learn from our Research

We share professional crude oil price intelligence, research and insights.

Unsubscribe at any time. 60,000+ people are now receiving our research.