Saudis lose US clout over oil price war

In an event that went largely unnoticed, we have, in fact, passed the point in human history where OPEC's key member Saudi Arabia can dictate oil prices any longer. No one seems to have taken in the momentous occasion if not comprehended its historical significance. Much hasn't been said or written, it has to be added.

Long time readers of oil-price.net will recall how as early as 2012 we had not only predicted the takeover of the entire region by ISIS, but also anticipated in 2013 that a surge in oil price volatility was on its way. In addition, we carried a comprehensive analysis, just weeks before the oil price collapsed.

Today we are at a similar turning point of a major milestone clustered with many defining clauses. Consequently, there are some drastic geopolitical implications for all nations from the producers of the Middle East to western democracies; from consumers in Asia to Europe. The world is about to change. Here's how.

How does OPEC work?

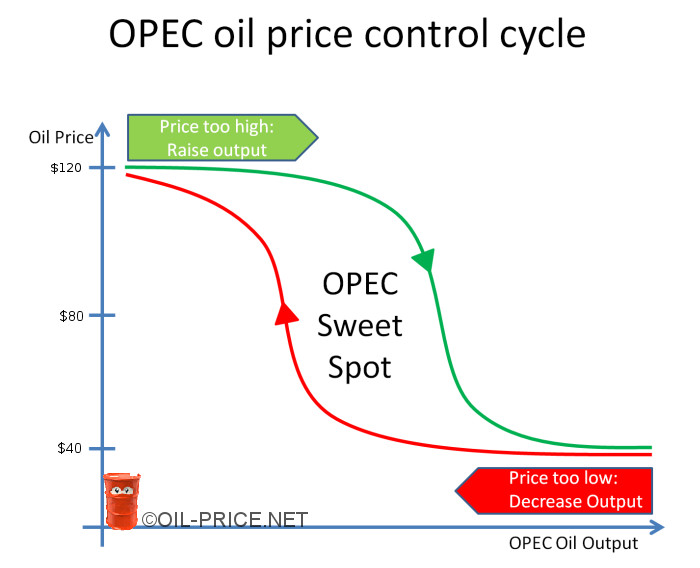

OPEC (Organization of the Petroleum Exporting Countries) is a consortium of thirteen countries, headquartered in Vienna. Together, these countries account for about 40% of oil production and more than 70% of world's proven oil reserves. For the past four decades OPEC has had a wide range of influence on the oil sector, and thus on the energy scene of the world. Simply put, OPEC is a cartel whose goal, since its creation in 1960, has been to coordinate oil prices in order to ensure that oil producers received a steady stream of income. The mechanism used by OPEC to control oil prices has been fairly straightforward; in technical parlance it's a "hysteresis cycle", the same logic used by a thermostat to control room temperature.

That is, if oil prices climb too high, OPEC decides to sell a little bit more of oil in the open market so that the oil prices go down. This is to avoid slowing first-world economies which would cause them to import less oil. In other words, it takes the sting off its tail.

On the other hand, if oil prices fall too low, OPEC reduces oil production so that oil prices spurt. With cut in supplies, demand rises, after all. This way OPEC wrestles to keep oil prices high enough to maximize profits. This hysteresis cycle started in the 70s itself when reduction in oil production by the cartel led to immediate spike in oil prices. In the eighties, OPEC started to set production targets to streamline the oil price. In April 2001, OPEC reduced production by one million barrels, whose effect as oil price increase was felt in the US, almost immediately. And, in November 2006, it reduced production by 1.7 million barrels so as not to sledge off the prices below the $50 per barrel mark. You see, the cartel had clout.

Now the scene moves to Saudi Arabia. The kingdom being the largest producer (and exporter of oil) of OPEC, has become the de-facto leader that few OPEC members dared oppose. During its first 54 year history, this mechanism worked great for OPEC, so why upset the apple cart, opined the rest of the OPEC members. After all, the said mechanism guaranteed a steady oil supply which, in turn, fuelled economic exchanges and progress during the last half-century with an unprecedented increase in prosperity worldwide.

Meanwhile thanks to new unconventional methods, the American oil revolution was well underway and when in 2014 the US passed Saudi Arabia as the first oil producer, Saudi Arabia, naturally, did not like it. Clearly, it was used to everyone bowing to its tune. And so Saudi Arabia decided to deal with US oil producers like the dictatorship usually deals with its opponents: a public beheading for everyone to see. Unexpected to everyone, the Saudis forced OPEC to increase production. It calculated that oil prices would plummet and the US producers would be priced out of the market. The logic was sound as fracking remains an expensive process. This move from Saudi Arabia was, of course, historical. No-one could have predicted nor anticipated. Not even Warren Buffett, usually right, but who recently admitted of his mistake in investing in Conoco Phillips because of the whole "peak oil" thing.

And, here's the rub, it worked. The string of bankruptcies which ensued rivalled the size of the telecom bust. Close to 70 oil and gas companies in the US filed for bankruptcy in the US so far, with more to come. The scheme set in motion by Saudi Arabia was gaining momentum.

Saudi Arabia pays the price for its actions

What Saudi Arabia thought of as a fool proof plan quickly fell on its face. Yes, history will remember Saudi Arabia's actions as very ill-planned indeed, because in the matter of months following did happen:

- Saudi Arabia lost its grip on OPEC

- OPEC lost grip on oil prices

- Riyadh lost its most precious political ally, the US oil industry

- US came clean on its relations with the Saudi Kingdom, lifting the veil of secrecy

- Western democracies took note of Saudi Arabia's increasing arrogance and now perceive Saudi Arabia in a negative light

- Saudi Arabia is on track to run out of cash with no plan to survive low oil prices

Now, for the details.

The day OPEC lost grip on oil prices

Respectable leaders lead by example and by breaking the golden rule of 'supply control' and by demanding others to obey, 'leader' Saudi Arabia not only harmed other OPEC member countries, but also lost all its credibility. And, reputation is one that is difficult to salvage once lost. Saudi Arabia did what it did, but the effect was felt by all. Breaking the rules of OPEC caused extreme hardships for other OPEC members. For example, Venezuela and Nigeria's oil payments contribute more than 90 percent of their total revenue from exports. Now, after Saudi's ill timed move, both countries are not only crumbling under massive revenue loss because of low oil prices but are also on the brink of famine and civil war.

Ever since then, OPEC hasn't been able to act in a cohesive coordinated way. So much so, OPEC meetings nowadays beget mayhem as members don't respect quotas any longer and are just happy to 'get something' for their oil. OPEC's clout has crumbled. The cartel has lost the cohesion that once made it strong.

SA lost key political allies

Evidently, harming the American Oil revolution cost Saudi Arabia support from US oil lobby. For decades, the Saudis and the US oil industry was a match made in heaven. It was a honeymoon phase all along. Generous oil contracts were handed to US oil companies to develop the Kingdom's vast oil resources. Saudi Arabia hired lobbyists to curry favour in the political arena too. After all, US oil companies are political heavy weights. Understandably many past US presidents from both parties had dubbed Saudis a key ally in the region.

However, the numerous oil bankruptcies in the US built resentment throughout the US oil industry. It turned out harming the US oil industry to be was an ill-fated political move by Saudi Arabia which lost its most influential ally in Washington. Also, it's an election year in the US and politicians, both Republicans and Democrats, do not want to be seen courting Saudi Arabia.

Take the case in point: Republican front runner Donald Trump has been an outspoken critic of Islamic fundamentalism and Saudi Arabia. Trump even made the declaration that he would stop purchasing oil from Saudi Arabia if it did not provide troops to fight ISIS. And, he had the choicest expletives for Prince Alwaleed Talal nicknaming him as "the dopey Prince". Let's keep in mind that these apparently candid retorts and all statements on the campaign trail are indeed carefully crafted by image consultants; in the case aforementioned this is meant to achieve the following end-goals:

- Being outspoken against Islam gathered huge popular support at a time when acts of terror like the Orlando nightclub shooting are on the rise. Any politician, in a democracy, needs votes to get elected first and foremost.

- Denouncing Saudi donations to US politicians loud and clear sends a loud and clear message to Riyadh that its days of Washington coziness are over.

- It sets the context of openness and transparency for discourse, where freedom of speech is not muffled by the fear of offending a religious group.

This is a definite departure from the Republican's previous attitude towards Saudi Arabia. The Bush family's snugness to the Saudi regime has been a thorn in the side of Republicans since 9/11 and a detached outsider such as Trump brings a clean slate, signalling a clear break with previous allegiances.

Sadly on the Democrat side, much energy is spent on tiptoeing around the issue in an effort to court Islamic voters, in a manner identical to Europe's socialist parties, at the expense of other minorities. This betrayal of values has also been such a thorn in the side of the Democrats that Hillary Clinton broke the party line and joined Donald Trump in criticizing Saudi Arabia for funding terror. Expect political one-upmanship all the way to election day in denouncing Saudi funding - which ironically both parties have gladly accepted for years.

It will never be the same in Washington for Saudi Arabia, ever again.

Still, until the election, Washington had to do something and it did. It turned its back on the Kingdom by re-kindling relations with Iran, Saudi Arabia's arch enemy cum rival. Sanctions on Iranian oil were lifted officially in January and a nuclear deal was inked last summer. As a result, Iran has become a key player in OPEC's stalemate.

Not stopping there, the US also did just what Saudi Arabia feared the most: it started a motion to open its previously secret dealings with Saudi Arabia to public scrutiny.

Lifting the veil of secrecy

Secrecy chapter between the US and Riyadh has been a long time affair. During the 1973 oil crisis, Saudi Arabia forced OPEC members to cut oil supplies to the US in retaliation for its support of Israel in the Yom Kippur war. The oil prices went up, as did inflation and OPEC realized its power. So much so, the then President Nixon sent in Henry Kissinger, the secretary of State to cut a deal. With the assistance of US Treasury Secretary William Simon, a deal was made with the Saudis: they would buy US debt (bonds) with petrodollars to finance consumer debt and trade deficit of the US. Of course, there was a catch. The amount of US debt owned by Saudi Arabia would never be made public but rather published as a bundled figure for Middle-Eastern state. This way Saudi Arabia's influence would remain concealed from public scrutiny. By 1974, the petrodollar was in rage with many oil producing countries wanting a way in. Come 1975, all the OPEC countries agreed to price oil in dollars. The petrodollar was born, key contributor to the American economic hegemony.

This historical secret agreement worked great for both the US and Saudi Arabia. Neatly, the US was able to outspend Russia throughout the eighties while Saudi Arabia funnelled Islamic fighters including Osama bin laden to oppose Russia in Afghanistan. By 1991 the USSR which could not keep up with US spending collapsed. The cold war was over.

This agreement was kept secret for over 40 years. This is the key to Saudi Arabian foreign policy: to cut secret deals with heads of states, away from the populace. Secrecy is the key for Saudi Arabia. That is, until now.

The whole thing came to a crescendo as it was made public thanks to the US freedom-of-information act. Well, this release of information was "helped" because US/Saudi relations were deteriorating rapidly. Earlier, a bill went to congress Justice Against Sponsors of Terrorism Act (JASTA), that will, if passed, allow the families affected by the 9/11 terrorist acts to sue the Saudi Government (15 of the 19 hijackers were Saudi nationals). Enraged Saudi Arabia resorted to extortion by threatening to liquidate its US bonds if the bill were to be passed.

Until now, no-one seemed to know for sure how much of the US was "owned" by Saudi Arabia. Now the data is public: a mere $117 billion. Significantly less than 10% of either China's 1.25 trillion and Japan's 1.13 trillion. In fact, Saudi Arabia doesn't even make it the top 10 creditors. Lifting the shroud of secrecy is America's way of telling Saudi Arabia publicly: "look, we don't have any reason to fear you. Because you have no game."

SA unpopularity grows in the west

It's an intricate web of a complex story but in layman terms - Saudi Arabia funded the Muslim brotherhood to impose Sunni control over Middle East. When the Muslim brotherhood spun out of control, the Saudis retracted and washed their hands off. The same happened in Syria. Saudis funded the insurgent groups in Iraq and Syria including ISIS. When ISIS got arrogant, the Saudi regime withdrew into its shell again like a tortoise. Saudi Arabia funded the war in Yemen which is still ongoing. Last year, unsurprisingly, Saudi Arabia became the world's largest military spender at a time where western weapon system increasingly fall in the hands of terrorist groups. The world has slowly woken up to the fact that it was Saudi Arabia's insistence to fund overthrow of Assad over the Qatar-Turkey pipeline to control oil to Europe that caused the migrant crisis.

In a nutshell, the migrant crisis and the surge in home-grown terror, routinely threatening European capitals, can be attributed to Saudi ideological exports. As a result, Western democracies have taken note of Saudi Arabia's agenda and now perceive Saudi Arabia in an extremely negative light.

Of late, terror attacks in Paris and Orlando have awakened Western democracies to the perils of Saudi Arabia's cultural export. After 40 years of Wahhabist influence, fundamentalist Islam is alive and well, even standard on European soil. As things go, since the fall of communism, fundamentalist Islam exported by Saudi Arabia is unequivocally acknowledged as the number one threat to western way of life.

Increasingly, with the string of investigative reports, lot more people are aware of Saudi Arabia's role and Saudi Arabia is being blamed for using oil revenues for destructive purposes. Thankfully Europeans and Americans can elect their own leaders who value transparency and reflect their own values. This is a central topic on the US campaign trail as well as in Europe.

Saudi Arabia flinching

With drastic cuts in public spending, Saudi Arabia is already feeling the pinch of falling oil prices. Saudi Arabia has already spent 1/5 or $140B of cash reserves, since the oil prices crashed, to maintain its heavily subsidized social system. The kingdom needs the oil prices at $89 or higher to break even, whereas today it sells a barrel of crude for exactly half that price. At the present rate the Kingdom will become insolvent within 4 years.

It would be an understatement to say that Saudi Arabia relies on high oil prices. Oil accounts for about 92.5% of state revenue and represents 55% of GDP. This problem is compounded by the fact that Saudi Arabia cannot levy taxes on its citizenry for two reasons: first, tax payers universally demand the right to vote on how money is spent. Voting implies choosing rulers and this is unacceptable for a theocracy founded on writings unchanged since the 6th century. Second, the Kingdom's workforce legendary low rate of productivity renders it nearly unemployable, so much so that 93% of its private sector is staffed by foreigners. So Saudi Arabia is left to auction off Saudi Aramco in an attempt to attract foreign capital and delay the inevitable.

In addition, liquidating US assets may be the only choice left for Saudi Arabia. If convicted of assisting terrorists by an American court, the US can and will seize Saudi assets held in US dollars. Which, it has to be pointed out, would abruptly accelerate the timeline to default. Understandably, few financial institutions want to run the risk of being associated with a rogue state on its way to bankruptcy. Consequently Saudi Arabia's debt rating was cut to A2 by Moody's in May. This is the second cut in a few months following S&P's cut to A+ .

The smart money is noticing that Saudi Arabia is faltering and has no plan B to survive low oil prices. Not only are politicians turning their backs on Saudi oil, so are financial institutions.

What does it all mean for oil prices going forward?

Saudi Arabia's former might hinged on the respect it received from OPEC members, which gave it control over OPEC outputs - and de-facto control of 40% of world oil output, way more than its share. Now that OPEC members have lost trust in Saudi Arabia, its leadership has evaporated. We are transitioning to a time where open trading on world markets has more impact on oil prices than artificial supply control by OPEC.

Further, thanks to new advances in oil production we can extract oil from unthinkable locations at competitive prices. More importantly American ingenuity can do that on short notice and on such a massive scale that it turns the oil market on its head. Dependence on Saudi crude is declining every day. Finally, Saudi Arabia has found its match. If it thought that Iran was its rival, it has found a more portent one in the West.

Sure oil prices plummeted to $26 and caused turmoil in the industry. Yet, as usual, markets self-regulated and prices are now stabilizing at around $50. In the long term, this is far more reliable than the old "cartel-controlled" oil market because it is more transparent and self-regulating.

Market dynamics function efficiently for all other commodities (such as corn or steel) without a cartel to artificially create scarcity. In essence, taking the OPEC cartel out of the picture increases market efficiency. It is straightforward: the money that is no longer retained by OPEC sheiks to buy Ferraris and ship Imams to the US and Europe is instead allocated to productive endeavours such as funding medical research. It makes the world a better place.

Let's face it. Many (if not most) Middle Eastern rulers were either deposed or hand-picked with "assistance" from western powers. Recently Egypt's democratically elected Muslim Brotherhood was replaced by the Egyptian army, second largest recipient of US military aid behind Israel. Saddam Hussein came to power with US assistance but was overthrown in 2003 after planning to trade oil in Euros instead of dollars. Iran's democratic government which intended to nationalize oil fields was overthrown and replaced in 1953 with the Shah backed by the US and UK. Examples galore. Each time a change of leadership took place it was because western interests tied to oil were threatened by a ruling body which got a little too bold.

It seems a page is about to be turned in the history of the Kingdom, sometime between now and 2020. Given the strategic importance of its (albeit overestimated) oil reserves, one needs to tread carefully in order to avoid a replay of Iraq. In post-Saddam Iraq a leadership vacuum caused fundamentalists to rise to power after a period of unrest, and this should be shunned at all cost in favor of a smoother, more legitimate transition. Thankfully more than 15,000 Saudi princes call the Kingdom home and just as an oversupply of oil created a buyer's market, there is no shortage of candidates to turn things around for the greater good.

Published on 2016/06/20 by STEVE AUSTIN

Learn from our Research

We share professional crude oil price intelligence, research and insights.

Unsubscribe at any time. 60,000+ people are now receiving our research.