The downside of low oil prices

At first sight it appears that low oil prices are good for society. A low oil price helps us save dollars at the pump, acts as an economic catalyst making exchanges cheaper and thereby stimulating the economy. However, there are downsides as well, often out-of-sight-out-of-mind and we will address these today.

Change in economic model

For the first time we have entered an era of sustained low oil prices. For a start, we have explained the 'why' part this article on the ongoing oil price war.

On the mainline, there is THE Saudi Arabia factor. The kingdom is relentless on the oil front. For June alone, Saudi Arabian exports increased to a three-month high at 7.456 million barrels per day, the highest for the month since 2012. The record of sorts happened with an oil production of 10. 55 million barrels per day. For July, the oil production increased a tad higher to 10. 67 million barrels. Our analysts expect more oil production in August. For its part, Saudi Arabia stated that the production surge was due to seasonal domestic demand and also because of customers asking for more oil globally. Partly that's true as output rises in summer due to increased electricity consumption but, well, the power plants burned less oil to generate electricity compared to the previous year.

In fact, the kingdom usually exports less oil in summer so that there is enough crude to generate electricity and power those air conditioners. So, if Riyadh continues to export record high barrels of oil, it only means that there is more production. Whatever it is, the elemental theme is that Saudi Arabia could well overtake Russia as the world's top oil producer soon, even as it holds the record as world's largest crude exporter. Now, you know the clout the kingdom wields. 'With great power comes great accountability' or was it 'great responsibility'. If the question is whether Saudi Arabia would use the power responsibly, you are barking up the wrong tree. Look, they held production for well over much of 2016, didn't they?

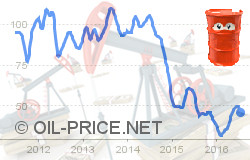

In 2014, oil prices hit $115 and fell to $27 this January. Consequently, all oil-producing countries were affected. The rule held true for Saudi Arabia as well. In many ways, it was its own doing. Last April, the Kingdom didn't want to freeze production in spite of the supply glut in the market. Calls to that effect from Algeria and Venezuela, reeling from the fall backs of low income, fell on deaf ears. Then, of course, there's the OPEC talks scheduled for September. Will they freeze production? Only time will tell.

Inevitably, Saudi Arabia is desperate. It has adopted austerity measures and slashed government spending. Thousands of laborers, from South East Asian countries have been left to rot without wages for about eight months now. In this stuffy scenario, the whole Middle East is burning. They've enjoyed a lifestyle for decades subsidized by the west's oil imports and are coming to the realization that they missed the boat and it's not coming back.

Basically, following Saudi Arabia's lack of leadership, OPEC has crumbled and the cartel's ability to control output to maximize Middle Eastern profits went out the window. The attempts to scuttle the shale oil industry in the US and intimidate the Iranian oil industry has ricocheted and how.

Meanwhile, Russia which was ready to freeze production in April, is producing oil with renewed vigour. At present, Russia's oil production stands at 10. 85 million barrels per day. Elsewhere, Iran has signalled that it will not stop until the production reaches 4. 6 million barrels per day. For now, the production hovers around 3. 850 million barrels per day. When the market share of Iran fell with additional sanctions, Saudi Arabia gained what Iran lost. With the sanctions almost lifted and the oil industry progressing fast with more projects and infrastructure, Riyadh is wary. Iran exported about two million barrels a day in June. If Riyadh wants to hold on to that sumptuous market share, it has to increase output. On the sidelines, Riyadh has shelved prices for Asia in an attempt to capture that market.

The whole market dynamics have changed as a result of Saudi Arabia's master plan. Crude oil is no longer a commodity whose price is controlled by a cartel. It has become a commodity subject to supply and demand like any other commodity. And since there is plenty of supply, crude oil prices remain flat for a long time.

Sustained low oil prices vs previously cyclic prices

As a result of this new "normal" market dynamic, we have entered an era of sustained low oil prices. Previously the calculation was pretty simple. OPEC would cut output when prices dipped to send the barrel past $100 and voila, there was the profit. Look at the scenario now. OPEC (esp. Saudi Arabia) desperately floods the market with crude, hoping to maintain market share and stay geopolitically relevant.

There's no way Saudi Arabia is going to cut production. Already the oil behemoth Saudi Aramco's IPO is slated for 2018. With Saudi Aramco going public, Saudi Arabia can, effectively, wash its hands off any decision they make regarding oil. If asked, Riyadh can simply state that the oil company was privately owned and thus outside the ambit of their control. The timings are about perfect too. Riyadh is reeling under massive budget deficit and it's not going to concede any market share.

This new dynamics means that oil prices will remain sub-$55 for a while. Stability and affordability is a good thing right? Not for everybody. Previous low in prices could be weathered by energy-focused nations as they built assets in good times. But those days are gone and asset reserves are depleting. From transport to hospitality, oil drives a whole gamut of income generating activities. When these dry, the economy is affected as the spending power shrivels too.

In general over the years most producers have grown accustomed to oil revenues. All oil-exporting countries (except Norway) have comparatively had less emphasis on education, funding research because of the lack of necessity to do so. Now that the world is so advanced technically, it's much harder to catch up.

First-world example: Canada

The relationship between Canadian dollar (CAD) and oil has been thick and strong for the past fifteen years. As testament to the fact, the CAD gets stronger when the oil prices rally. This is because Canada is the seventh largest net exporter of oil. It also holds the world's second largest (estimate) reserves of oil after Saudi Arabia. During the nineties, the Canadian dollar was classified as a weak currency but that changed with the oil moving towards $100 a barrel. When oil prices fall, so does the CAD. At the present scenario, we at oil-price.net expect the Canadian dollar to weaken further against the US dollar in the next three months. We also expect it to pick up pace next year.

To add to the woes, the wildfires in Northern Alberta forced a halt in production robbing about 1.1 percentage points from the GDP. Unemployment rates rose to a record 8.6 percent last month in Alberta, the highest in twenty-two years, with a consequent spike in food banks. In provinces like Alberta, Saskatchewan, Newfoundland and Labrador, all dependent on oil, the delinquency rates have increased with the layoffs from the energy industry. In other words, people are unable to repay debt.

Since 2014, more than twenty oil sands projects have gone to the back-burner for want of investment. Moreover we at oil-price.net do not expect the oil industry to rebound until after 2020. If not for the housing sector and financial services, Canada would have been in dire straits.

Though not in recession, Canada's budget deficit runs into billions and it's looking at federal fiscal stimulus to spike growth, which has been sluggish in the second quarter. Canada's biggest trading partner, the US growing at just 1.9 percent, isn't providing the much-needed demand yet. The Bank of Canada like the US Federal Reserve is poised to keep the interest rates unchanged. The current rally in oil prices isn't inspiring growth. If the oil prices bounce to above $50 CAD would rebound but for investments to roll in the prices have to hit the $60 mark.

Resonating with the low oil prices, Cash strapped Canada has cut education and healthcare spending. Canada is also declining in academic research because of dependence on energy. It's a mighty shame that in spite of being a modern country Canada is suffering.

Russia

With a hulking of a presence, Russia is the world's biggest crude oil producer and second biggest exporter after Saudi Arabia. The Russian economy dependent on fuel exports in no uncertain terms has taken a huge hit with weak prices. Oil and gas contributed to more than forty percent of Russian state revenue in 2015. This year, the federal budget deficit has climbed up while the GDP has contracted.

In short, Russia is under a protracted recession. In the second quarter, the economy shrank by 0. 6 percent and is expected to decline by an added 1.8 %, in 2016, according to the IMF. Apart from the economic sanctions, decline in private investment and weak demand in the domestic market, it's the oil prices that have worsened the economy. Russia's increased military spending especially in Syria has resonated to exacerbate the agony, depleting the purchasing power of the people. The government is using reserve fund for its budget but the fund will run out this year. What after that? Since Saudi Arabia is giving out heavy discounts to the Asians, Russia is losing out in Asia as well as in Europe. Indeed, Russia is, if not anything, more and more aggressive as a result of low oil prices.

More to the point, the oil industry under a few powerful oligarchs has been allergic to modern changes. The government, for its part, has shied away from reform and modernization. The government has in fact shelved the sale of its stake in the mid-sized oil producer Bashneft after the hyped privatization drive. This comes at a time when Moscow is badly in need of revenue to meet budget targets.

Moscow's MICEX has rallied to an all time high of 1,977 beyond expectation. However, the forecast for the economy isn't rapturous. The World Bank expects the Russian economy to fall to 1.2 percent. IMF predicts Russian economic growth by just one percent in 2017.

Third-world mayhem

In many ways, the low oil prices have been particularly hard on Venezuela. Oil is almost exclusively the only source of export revenue, and the fallout has been intense.

The country has the world's largest proven oil reserves in the world. Yet, Venezuela's oil production is at a thirteen year low. In June, the country produced 2.1 million barrels a day. By contrast, it was pumping 3 million barrels a day in 2008. Yes, electricity problems did affect oil production. Yet, the main reason for the storm, in extension, is underinvestment in infrastructure and mature oil fields. Consider this - Venezuela just failed to replace the ageing infrastructure. The natural decline rate of the oilfields are at the rate of 15% to 25%, according to Columbia. And we are talking about decades of decline. As oil prices slid from $110 a barrel, the agony began with a clean sweep. With soaring oil prices it would have been easy but lack of maintenance was the story even when the oil prices were above hundred dollars a barrels. When the country did wake up to the problem, the oil prices had slumped.

The economy, overly dependent on oil is in tatters. Trade balance, international reserves, government revenue, finances are all in disarray. The oversupply of oil in the market hasn't helped, either. The oil exports have been uninspiring too. The state owned PDVSA is in debt unable to repay the bondholders. PDVSA is also struggling with a shortage of light crude in the Orinoco Belt. Since Venezuela produces heavy oil, it needs light crude for blending and the bills of import are just too much for the battered economy. Per our own analysis, we estimate that oil production will fall by another 1 million barrels a day by the end of the year.

Venezuela has oil, just not cheap oil. The country is reeling under short supply of basics like food and medicine. The inflation is too high with law and order problems. The challenge it faces is mammoth.

The case is similar in Algeria. The country is over dependent on oil and gas with exports of hydrocarbons contributing about 95% of export and 75% of budget revenue. Unlike Venezuela which needs the oil prices at $50 or $60 a barrel, Algeria would need oil prices to cross the privileged hundred-dollar barrier to support the budget. Fiscal deficit has risen to 15. 7 % of GDP in 2016 from 1.4% of GDP in 2013. Inflation has soared. The government has taken an array of corrective measures like reducing government spending and non-recruitment of people in the government sector. All of which will affect the people. Economic diversification, though, is the key.

US and oil-importing economies

As it stands, one main reason for the over-supply of oil in the market is Shale oil from the US. Ballasted by shale oil, US energy security emerged unfussy and fine-tuned. The output has been staggering. The EIA estimates U.S. output to average 8.73 million barrels per day in 2016 and 8. 31 million barrels per day in 2017. Shale oil and gas extracted using hydraulic fracturing has revolutionized the oil industry. In many ways, it's shale that has contributed to the lower oil prices. How? Well, since the U.S. was producing oil in plenty at home, the imports declined. Now, the imports had to find another market, right? Everyone, from Saudi Arabia to Algeria is targeting Asian markets, in the process supplying more oil to the already saturated markets. We've already seen how Russia and Saudi Arabia continue to produce in spite of low prices. For the week ended August 5, the crude inventories in the US gained 1.1 million barrels for the third straight week, according to EIA. Paradoxically, only low oil prices will clear out the inventory.

Earlier, any turmoil in the Middle-East acted on oil prices. That equation changed forever with the arrival of US shale oil in the market. The story is extraordinary sending US oil production to their highest in three decades.

Extracting oil and gas from shale is very expensive; however, oil companies have to keep at it to get some sort of income. At present, there is virtually no well that's pumping at a profit in the US. Oil has to trade above $55 per barrel to be 'economic' for the companies.

At first low oil prices benefitted retail, households that use heating oil and the transportation sector but it was a one-time thing. Since then the economy has slowed down. This is because a lot of the US economy is tied to energy. At the peak, 20% of the stock market was in energy-related companies. So low oil prices did hurt sections of the economy, and states depending on it like Texas and North Dakota. In the oil and gas sector, companies have axed 17, 000 jobs since October 2014, according to U.S. Bureau of Labor statistics. In the last four years, active ring count in North Dakota has fallen from 200 to 49, while in Texas it went from 697 to 271 in just one year.

Oil companies like Noble Energy, Marathon Oil. Corp., an Occidental Petroleum Corp. have all reported losses in the second quarter because of stunted oil prices. Royal Dutch Shell, BP and Chevron have cut jobs. Increase in road travel because of cheap fuel has taken many lives too. That is, people use the gas saved to buy more gas. Yet, spending hasn't increased to bolster demand.

Europe and Asia

Europe (except for Norway) is dependent on oil imports. With low inflation and lukewarm growth, the low price ought to have been a welcome sign. Yet low oil prices have not boosted Europe's economy which is still sluggish. It has however contributed to the welfare migrant crisis, a geopolitical disaster. Also Europe's export economies are hurting from the lack of imports in cash-strapped oil-exporting countries, contributing to languid economies.

With utter desperation, all oil producing nations are targeting Asia with desperation. China, which is a net importer of oil should have gained far more. But the lower oil prices didn't prop up the economy as expected. For Japan, suffering from deflation, the effects of low oil prices has been, for better or worse, mixed. For India, the low price is expected to improve the current account deficit but the government is yet to pass on any significant benefits to the customer at the pump.

Conclusion

In all the countries discussed, the scenarios are myriad but stories similar. Export earnings of oil producing countries slip down affecting income generated. In turn, low-income cuts government spending on food, education and medicine. Well, low oil prices stymie growth. Layoffs are common and since the oil industry supports a whole gamut of allied industries like transportation, hospitality and townships, they affect all. Further, cheaper oil prices means low investment and that would soon cascade as high oil prices. Oil has been around for centuries. Noah used pitch to seal his ark, didn't he? The Egyptians used pitch in the pyramids and mummies. For those saying, we can do without oil. Think again, can you?

Published on 2016/09/08 by STEVE AUSTIN

Learn from our Research

We share professional crude oil price intelligence, research and insights.

Unsubscribe at any time. 60,000+ people are now receiving our research.